Mutual Funds & SIP

What is a Mutual Fund?

A mutual fund is a professionally managed investment option that pools money from multiple investors and invests in a variety of assets such as stocks, bonds, money market instruments, and other securities. These funds are handled by experienced fund managers who aim to deliver consistent returns through capital appreciation and income generation.

Whether you’re a first-time investor or someone looking to diversify your portfolio, mutual funds are a flexible, transparent, and regulated way to build wealth. You can invest in small amounts and still benefit from expert management and diversification.

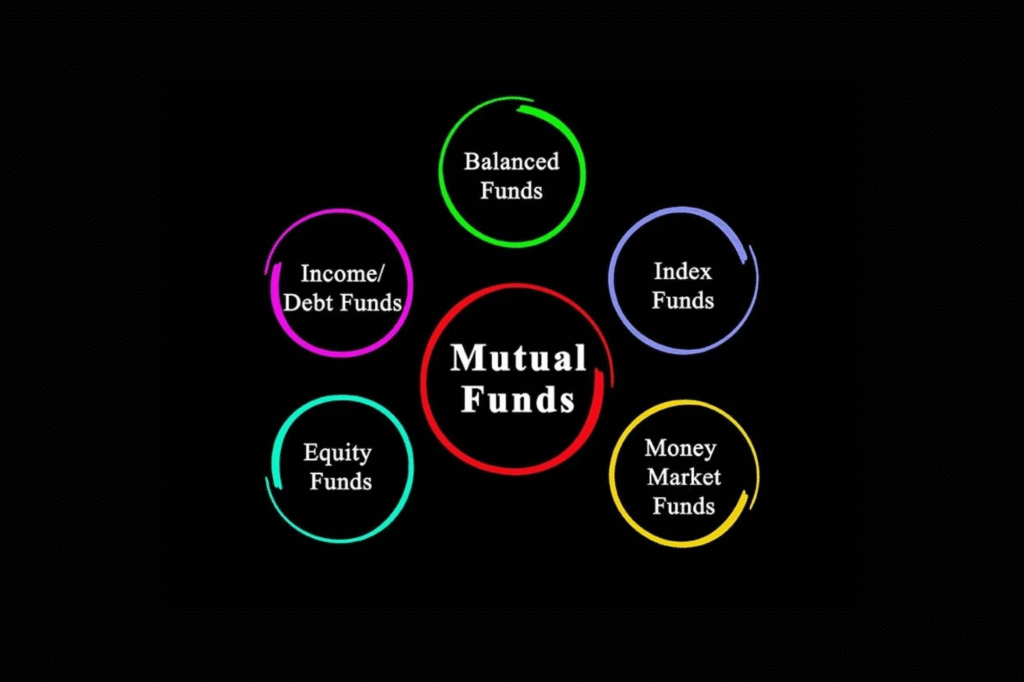

Types of Mutual Funds

At NSGFIN, we help you choose from different mutual fund types based on your financial goals:

- Open-Ended Funds: Invest or withdraw anytime at the fund’s current NAV.

- Close-Ended Funds: Invest during the initial offer period, with a fixed maturity.

- Actively Managed Funds: Fund managers make informed decisions to beat market benchmarks.

- Passively Managed Funds: These track index performance with low cost and minimal risk.

What is SIP ?

A Systematic Investment Plan (SIP) is a simple, disciplined way to invest in mutual funds. With SIP, you can invest a fixed amount regularly—monthly or quarterly—starting from just ₹500. SIPs are ideal for building long-term wealth without needing to time the market.

Just like a recurring deposit, SIP allows you to automate investments through standing instructions from your bank, making investing hassle-free.

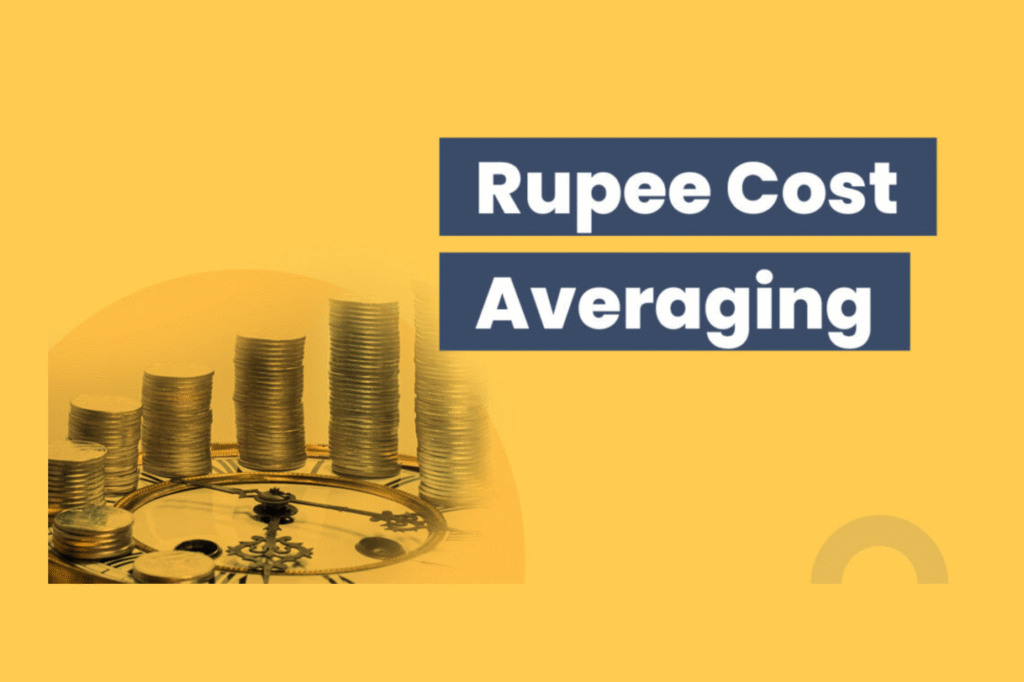

How SIP Works – Rupee Cost Averaging

SIPs help you benefit from a concept called Rupee Cost Averaging. When markets are low, your SIP buys more units; when markets are high, it buys fewer units. Over time, this averages out your investment cost and reduces the impact of market volatility.

Example:

- NAV = ₹20 → You get 50 units

- NAV = ₹10 → You get 100 units

Average cost = ₹13.33 per unit

This disciplined approach removes emotional investing and helps you stay consistent over time.